Assessing strength or weakness of a network effect: how defensible is it?

The network effect is one of the phenomena most talked about in technology – but one of the least understood in depth.

There is a tendency to simply make a binary assessment: a company either has a network effect or it doesn’t. In practice, though, a judgment is always subjective, and the effect is impossible to measure – in terms of expressing it in any formula that applies to the reality of all companies.

On the other hand, there are some variables that can indicate how strong or weak it is.

To shed some light on this, in our second session of the Astella Expert Network on Marketplaces we invited two of the world’s top specialists on the network effect, Andrei Hagiu (Associate Professor at the Boston University) and Julian Wright (Associate Professor at Boston University) and Julian Wright (Professor at the National University of Singapore) to give us some insights on what variables to weigh when trying to get a view of the defensibility of a network effect.

In this post I share some of the main insights and lessons that we gained from this second session of the Astella Expert Network on Marketplaces.

More about these two experts here.

Network Effect 101:

A network effect is what happens when a product or service becomes more valuable when more clients use it.

There are two types:

- Direct network effects – when the value of the platform increases simply because the number of users increases (for example: Zoom, or Discord); and

- Indirect (or cross-group) network effects – when a platform depends on two or more groups of users, such as buyers and sellers (Amazon, Alibaba, Airbnb).

Facebook has both: a direct network effect, between users and users; and a cross-group network effect, between users and developers.

For some more detail on this:

A NFX mapeia 16 tipos de efeito de rede possíveis.

https://platformchronicles.substack.com/p/network-effects-and-defensibility

The main theme of this lesson was to understand under what conditions the network effect causes a market positioning that is highly defensible, and thus whether the platform has what it takes to create a major company.

The Q&A below lists 7 factors that help define the defensibility of a network effect:

1. How much do users find it to be important that other users adopt the same product/service?

If the network effect is weak, users will not have much interest in whether or not new users enter the network.

On this point, there is a common area of confusion, between (1) network effect and (2) virality:

Users are not much affected by whether the product or service simply has virality, which often is confused with network effect.

For example, the focus on radical sports adopted by GoPro, which led to massive sales to this profile of clients, is not an example of network effect. It is an example of virality. There is not a gain for the nature and success of the network if a new user buys a GoPro.

Takeaway: Any product can create virality; few products actually have network effects.

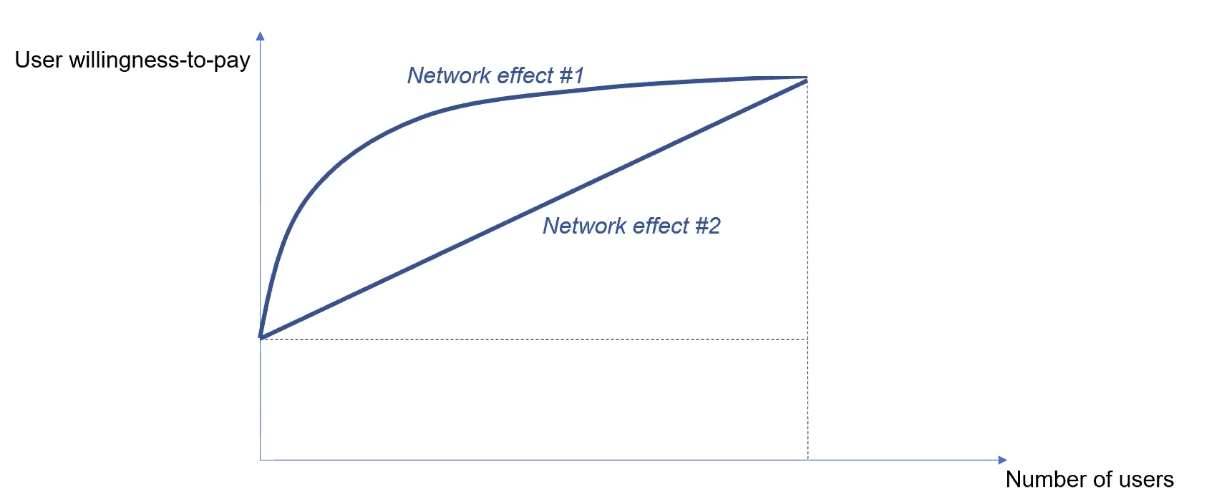

2. What is the marginal value of the network effect?

Network effects are more powerful when the marginal value of a new user decreases slowly:

∙ The millionth user added to Facebook continues to provide value, because their involvement creates increased liquidity for the platform;

∙ – but the thousandth English teacher in an online tutoring marketplace tends not to generate more liquidity for the platform.

Platforms with the #2 network effect have more defensibility: the more that both supply and demand are more fragmented, the greater the marginal value of a new user tends to be.

3. Are the suppliers differentiated, or ‘commoditized’?

All else being equal, the network effect is stronger when the suppliers are differentiated. The dynamics of a marketplace are dictated by the homogeneity (‘unicity’) or heterogeneity of their supply. Homogeneity of supply means the products offered have a standard nature (‘commodities’); heterogeneity refers to products or services that deliver a range of different value proposals to the final client.

When a product has differentiated suppliers (Airbnb, Cameo), the result is a much higher entry barrier – which is of great benefit to the company: it is much more challenging to replicate the supply of products or services that the network has achieved.

Julian and Andrei commented that this is one of the most important variables in assessing the network effect of an operation.

4. Is the network effect global, or local?

Global platforms have more defensive network effects, for obvious reasons: it’s much more difficult to become dominant on the global or national level than at the local level – being only local makes it much easier for local competitors to create copycat operations.

In Brazil, we don’t have any significant copycat competitors to Instagram, Airbnb, or YouTube…

– but in Brazil we do have significant copycats for Uber, DoorDash, and WeWork…

5. How difficult is it to achieve the same provider/buyer interaction on an alternative platform?

If it is easy to coordinate interaction between buyers and sellers on an alternative platform, that tends to mean the network effect is less defensible. Simple examples are chat applications such as Skype or Zoom. Switching cost is lower, because setting up an interaction on an alternative application tends to be easier.

6. Are matches instantaneous or delayed? (Synchronous or asynchronous?)

Achieving an intermediation in a synchronous (instantaneous) match requires more complexity in terms of liquidity – and thus means a more defensible network effect. Examples:

∙ Uber is synchronous – if I ask for a ride, it comes immediately.

∙ BlaBlaCar is asynchronous – if I ask for a long-distance car share, it might come tomorrow.

7. How difficult is it for clients to use similar competing services?

If the users of a platform also use similar services of other companies, this can be seen as a weakness of the network effect. For example, someone can easily be a multiple user of various ride-share companies – they might be frequent users of Uber, Lyft, and 99. When the company has a value proposal that is so strong that the clients don’t think of using a substitute, that can be seen as indicating a strong network effect.

A network effect is less defensible when the incentives for staying on the same platform are not very great.

**

The notes above are a rapid summary of the second conversation, with lessons very much in line with what we learned in Seven Lessons on Marketplaces, which you can read by clicking here.

.png)